The question is a common one. Where should an investor park their surplus cash balances?

Fordel’s CIO, Oliver Moloney has some views.

Before the latest rate hiking cycle there were very few options. For a Euro based investor, ECB deposit rates were below 0%, high quality European bonds were trading below 0%, and domestic Irish banks were charging (up to -0.65%) on cash balances.

The post global financial era brought many challenges in Europe. Several countries including Ireland, Greece, Spain, and Italy suffered significant financial stress, while larger economies such as Germany and France struggled with weak growth and low inflation. This resulted in 10 years+ of zero interest rate policies to spur economic activity.

The ECB increased rates by 4.5% (from -0.5% to 4%) between July 2022 and September 2023. Investors could suddenly earn yields above 3.5% on bank deposits and short-term cash instruments. However, due to the lack of competition in the Irish market, domestic pillar banks in Ireland have been slow to pass these on to Irish depositors. As a result, large volumes of funds moved into Money Market Funds—investment funds that buy short-duration, investment-grade bonds to track the cash rate.

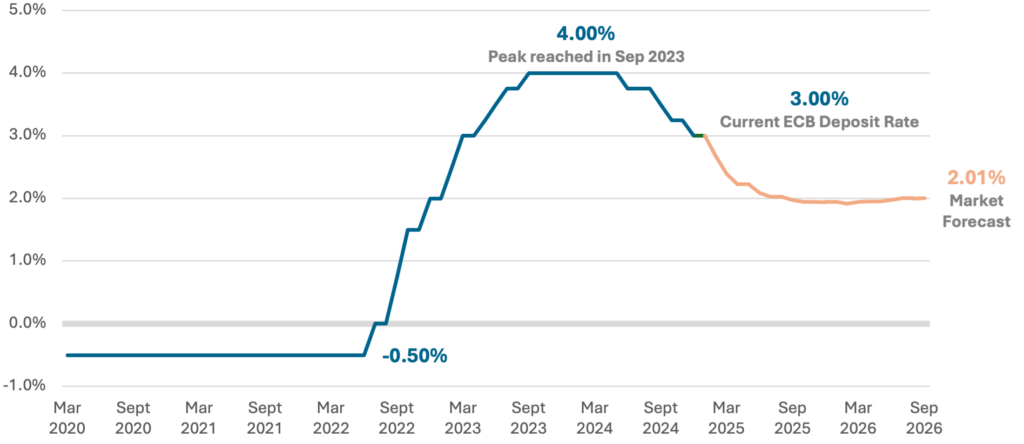

Graph 1: ECB Deposit Rate Forecast

Source: Refinitiv.

As you can see from the graph, the ECB has already brought rates down from 4% to 3% during 2024. The expectation is for a further 1% of cuts in 2025, leaving the central bank rate at approximately 2% going forward. While still a positive yield, investors may suddenly feel shortchanged versus 2023/2024.

There are no secrets when it comes to increasing returns. To achieve a higher yield an investor typically needs to move up the risk curve in some form. When it comes to fixed income securities this comes in the form of:

- Liquidity – in other words, increased illiquidity for the investor. Locking in cash for fixed periods offers the lender longer term financing which is preferable and therefore can lead to higher rates.

- Duration – when it comes to bonds, in a normal environment, increasing the duration of the bond would typically result in a higher yield. This also comes with more volatility on the price of the bonds.

- Credit – lending cash to a less creditworthy bank, government, or company typically results in a higher yield being offered.

When it comes to selecting an option, careful consideration must be made to the time horizon of the funds in question, and the investors willingness and ability to take on risk.

The three clear cash options are as follows:

- Bank Deposits – domestic retail banks offer fixed rates at 6-month, 1-year, and 2-year maturities yielding approximately 1.5%, 2.25%, and 2.75% respectively. These offer a fixed rate but lower flexibility as funds will be tied up for the term of the deposit. The investor is then subject to the creditworthiness of that institution.

- Money Market Funds – a cash equivalent that purchases a diversified basket of short duration European investment grade bonds/commercial paper/certificates of deposits. These funds offer daily liquidity and effectively are viewed as having little to no credit risk. Average duration of the underlying securities is typically very short (30 – 40 days). While an investor can access funds at short notice, we recommend holding the investment for 3 months minimum to avoid short term price fluctuations. At the time of writing Euro Money Market funds are yielding approximately 2.9% gross.

- Bond Portfolios – a well-structured bond portfolio can match an investor’s time horizon and risk appetite while optimising for yield. You will see from the below table that we are experiencing an inverted yield curve (short-term yields greater than long-term yields) which limits the attractiveness of longer duration fixed income assets. Longer duration also increases the potential volatility of the investment which must be factored in.

Table 2: Government benchmark yields.

| 1M | 3M | 1Y | 2Y | 3Y | 5Y | 7Y | 10Y | |

| US | 4.3% | 4.3% | 4.2% | 4.3% | 4.3% | 4.4% | 4.5% | 4.6% |

| Germany | 2.7% | 2.5% | 2.4% | 2.2% | 2.2% | 2.3% | 2.3% | 2.5% |

| UK | 4.8% | 4.6% | 4.5% | 4.4% | 4.2% | 4.4% | 4.5% | 4.7% |

Source: Refinitiv.

A key consideration is how can an investor implement the above strategies with as little transaction, management, and custody costs as possible. Cash and cash equivalents are effective short-term, low-risk investments, however, will likely just keep pace with inflation over the medium term. If an investor’s time horizon extends beyond 3 years, we recommend reviewing whether a longer-term multi-asset strategy may be a more appropriate investment strategy for surplus cash assets.

At Fordel we are here to help navigate the many considerations that go into making an investment decision. Please reach out to discuss how our team can assist you with your investment needs.